Godrej Group second step towards value creation in Agro-Chemical business

In a move to consolidate its Agro-chemical business, Godrej Group has decided to merge its acquired listed entity into its listed holding company.

Astec Lifesciences Limited (Astec), established in 1994, Astec Lifesciences Ltd manufactures a wide range of agrochemicals and pharmaceutical intermediates. Astec has two multipurpose production sites at Mahad. In August 2015, Godrej Agrovet acquired a majority stake in Astec. The equity shares of the company are listed on BSE and NSE.

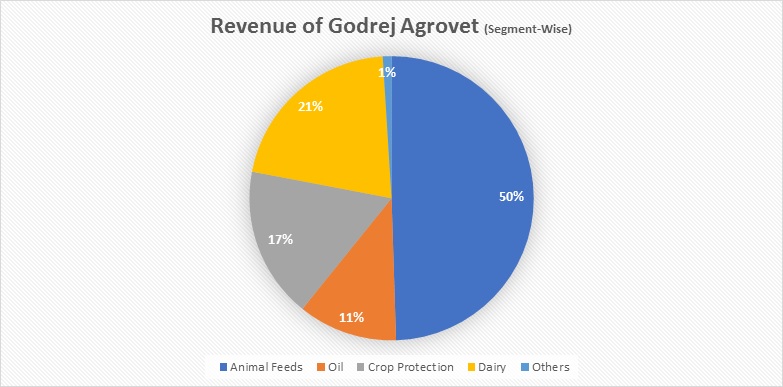

Godrej Agrovet Limited (Agrovet) is engaged is an agribusiness arm of Godrej Group with operations across five business verticals- animal feeds, crop protection, oil palm, dairy and poultry and processed foods. The equity shares of the company are listed on BSE and NSE.

Revenue Mix for FY 18

The Transaction

In a move to consolidate its Agro-chemical business, Godrej Group will merge Astec with the Agrovet. The appointed date for the transaction is 1st April 2019.

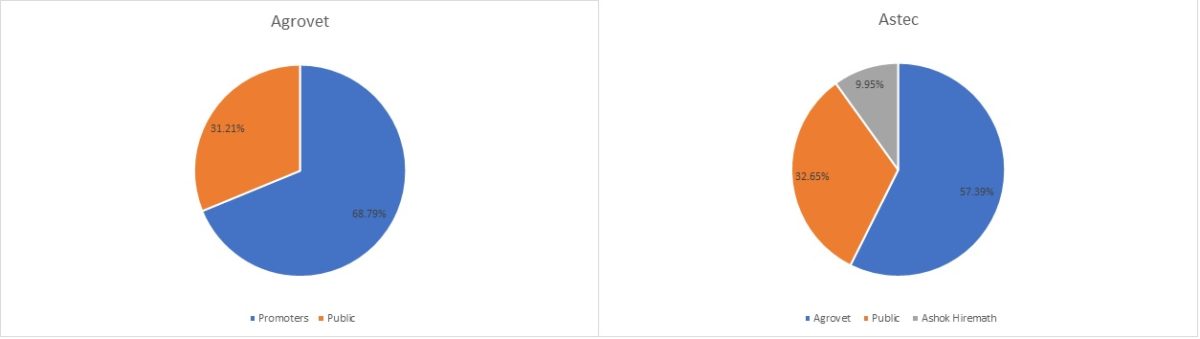

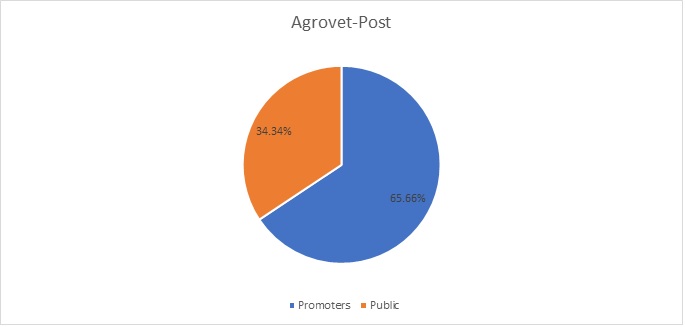

Shareholding Pattern

Swap Ratio

As a consideration for the proposed transaction, equity shareholders of Astec would be issued equity share in Agrovet in the ratio of 11 equity shares of Agrovet for every 10 equity shares held in Astec.

Post-Merger, Agrovet shareholding in Astec will get cancelled. Mr. Ashok Hiremath (Earlier Owner) shareholding will be holding ~1% stake in Agrovet and minority shareholders of Astec will hold 3.50% stake in the merged entity.

History – The First Step in 2015

Agrovet entered into the Share Purchase Agreement in August 2015 with Mr. Ashok Hiremath & Family, the earlier owner of the Astec for acquiring at least 45.29% of the Equity Share Capital of the Astec and completed the acquisition of 45.29% of the Equity Share Capital through an off-market transaction in October 2015. Pursuant to the execution of the said Share Purchase Agreement, Agrovet made a public announcement for acquiring 26.05% of the Equity Share Capital of the Astec from its public Shareholders through Open Offer. Thereafter, on 6th November 2015, majority of the Directors on the Board consisted of Directors nominated by Godrej Agrovet Limited. Consequently, Astec became a subsidiary of Agrovet with effect from 6th November 2015.

Further, Agrovet acquired 13,60,491 (6.99%) Equity Shares of the Company in December 2015 through Open Offer. The aggregate shareholding of Godrej Agrovet Limited as on 31st March 2016 was 53.64%.

2017-18

During FY 2017, Agrovet increases its stake from 53.64% to 55.54%. During FY2018, Agrovet came with the initial public offering. The issue price per equity share was INR 460 per equity share. In the same year, Agrovet purchased additional shares of Astec making its total shareholding 57.39% from 55.56%.

Valuation

Table 1: Standalone valuation of companies pre-merger

| Particulars | Agrovet | Astec |

| Assigned Per Share Value | 568 | 625 |

| No. of Shares | 19,20,28,739 | 1,95,46,155 |

| Equity Value (In Cr) | 10,900 | 1,221 |

Agrovet acquired 45.29% stake in Astec from the earlier owner for INR ~167 crore resulting in per share value of INR 190. Further, they acquire 6.99% stake through an open offer at INR 240 per equity share. In 2016, Agrovet acquired an additional stake of 2% for INR 581 per share. In 2018, they further acquired stake for INR 547 per equity share.

Financials

Table 2: Consolidated financials (INR in Crore)

| Particulars | Agrovet* | Astec | |

| 2018 | 2018 | 2016 | |

| Revenue | 5205 | 370 | 273 |

| EBIT % | 7.5% | 16.8% | 4.8% |

| PAT % | 4.8% | 9.5% | - |

| Networth | 1680 | 170 | 116.84 |

| Debt | 400 | 125 | 116 |

| Capital Employed | 2080 | 295 | 232.84 |

| RoCE | 19% | 21% | 5.6% |

| Market Cap | 9700 | 1030 | 400 |

*: Including Astec.

Agrovet Standalone agrichemical business (INR in crore)

Table 3: Standalone Agrichemical Business of Agrovet (All Figs in INR Crores)

| Particulars | Amount |

| Revenue | 511 |

| EBIT | 143 |

| Margins | 28% |

| Assets* | 624 |

| Liabilities* | 194 |

*: Approximate

Though on a consolidated basis, Astec performance is better than Agrovet but Agrovet’s Agrochemical business yield better margins than Astec.

Inter-Company Transaction

| Particulars | FY 18 | FY 17 | FY 16 |

| Sales | 9 | 10 | 0.5 |

| ICD Taken | - | 50 | 10 |

Apart from Agrovet, Astec had taken a loan from Nature Basket Limited & Creamline Dairy Products Limited worth INR 27 crore and INR 30 crore respectively. These loans are repaid in FY 2017.

Conclusion

The group supported Astec to expand its presence, operation and financially by giving ICD’s from various group companies. The group increased its holding by `4% even post-acquisition, which shows their confidence and commitment in the business. It looks they have completed the business integration of Astec with Agrovet and the group is now decided to implement step II for value creation i.e. legal integration by merging the entities. Further, the transaction would likely to give exit to the Mr. Hiremath from the management role and also as a promoter.

Good information. Thanks for sharing. If you want to know more about stock market related topics then visit

ReplyDeleteSBI Credit Card Business IPO

Tata Capital

Ujjivan Small Finance Bank

Spandana Sphoorty Financial Ltd