Alembic goes for demerger

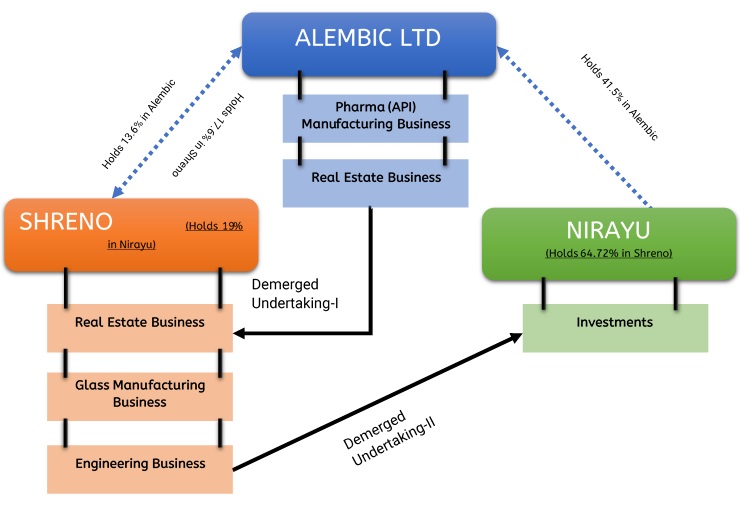

Alembic Ltd (Alembic), incorporated in 1907, is part of Alembic group and it is engaged in the business of manufacturing and trading active pharmaceutical ingredients (API) and Real Estate Developments. It also has investment in Alembic Pharmaceuticals Limited (APL).

Shreno Limited (Shreno), incorporated in 1944, is engaged in the business of manufacturing and trading of glassware items, machinery and equipments (engineering) required for various industries, making investments and real estate developments.

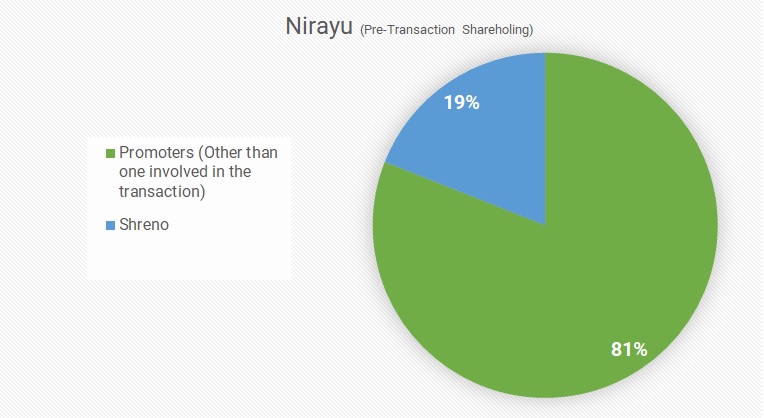

Nirayu Pvt. Ltd. (Nirayu), incorporated in 1971, is currently holding investment in shares and securities of various entities.

Current Shareholding of the companies

Please Note:

- 1% OCPS of Shreno limited of book value Rs. 8.71 crores were converted in equity shares by alembic Limited in FY 2018 Therefore the final total investment by Alembic in equity is Rs. 35.13 crores.

- Alembic acquired 55% stake in Alembic City Limited resulting into WOS of the company with Total investment of Rs. 07 Lakhs

Pre-Transaction

Post Transaction

Transaction Details

Demerger 1:

Demerger of Demerged undertaking 1 consists of current residential real estate project on land bearing survey no. 256/2 part admeasuring approx. 4500 square meters comprised in town planning scheme no. 13, by final plot no. 78, plot no 2, Vadodara 390024 along with real estate interest held through investment in Shreno and project management consultancy of Alembic limited into Shreno Limited with appointed date 1st November 2018 with swap ratio for every 1 equity share in alembic 1, 7% non-convertible cumulative Redeemable preference shares issued by Shreno limited.

Demerger 2:

Demerger of Demerged undertaking 2 consists of engineering and investment division along with interest held through investment in Nirayu of Shreno limited into Nirayu Limited with appointed date 1st November 2018 with swap ratio for every 1 equity share in alembic 1, 7% non-convertible cumulative Redeemable preference shares issued by Nirayu.

Pointer to be noted:

- Small shareholders have been defined as shareholders other than promoters who holding at the time of redemption is of amount less than 2 lakhs.

- Terms of Preference Shares

| Terms | Issued by Shreno | Issued by Nirayu |

| Coupon Rate | 7% | |

| Voting rights | in accordance with section 47(2) of the companies Act 2013 | |

| Face Value | Rs. 2 per share | Rs. 100 per share |

| No. of share allotted | 25,67,81,828 shares | 59,48,298 shares |

| Valuation | Approx. 424 crores | Approx. 1,874 crores |

| Issue price and redemption price | Rs. 16.50 per share | Rs. 3,150 per share |

| Redemption terms | Redeemed in one or more tranche anytime on or before expiry of 5 years from the date of allotment | |

| Please Note: o Small shareholders shall be redeemed at any time at the discretion of Shreno on or before expiry of 2years from the date of allotment. o They will be given first preference in redemption o If no redeemed by the company then Nirayu holding company will purchase from them |

||

- Non-Resident will be allotted preference shares if allowed as per FEMA regulations and RBI and if not then cash consideration directly or through merchant banker escrow account after deduction of withholding tax

- Inter Company Holding (Alembic Holding in Shreno and Shreno holding in Nirayu) will be cancelled

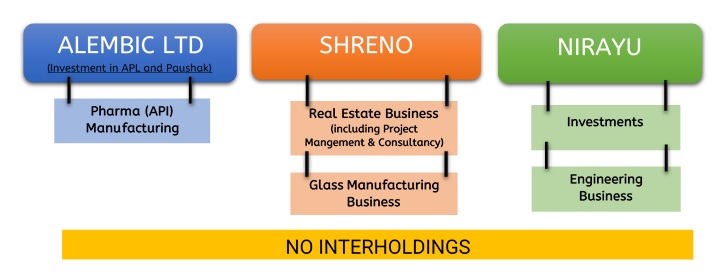

- Remaining Nirayu will hold investment and engineering division and will be converted in public limited company

- Remaining Shreno will hold Real Estate development and project management consultancy

- Remaining Alembic is major investment in Alembic Pharmaceuticals Limited and Paushak Limited and business of API.

- Allotment by Shreno to the shareholders of alembic will excluding it shareholding in alembic

Rationale of the Transaction

- Exit to shareholders other than promoters in real estate and project management consultancy division of Alembic

- Consolidation of promoters group companies into one promoter entity i.e. Nirayu limited, holding Alembic stake of approx. 54.74%. Previously amalgamation of Sierra Investments Private Limited and Whitefield Chemtech Private Limited with Nirayu Private Limited lead to 41.11 % stake in Alembic limited.

- Creation of additional liquidity for the shareholders of Alembic

- Elimination of intercompany cross holdings

- Enhancing shareholders value by creating leaner and focused organisations

Accounting

The accounting by the resulting is at pooling of interest method considering that business combination under common control.

Taxation

Income tax neutral as in compliance of section 2(19AA) of the Income Tax Act. However, there will be stamp duty implication of the Transaction.

Valuation

The Valuation has been arrived as follows:

- Unlisted cash generating unit has been valued applying DCF method (Reals Estate Division and Project management)

- Investment in unlisted non-operating companies has been valued at net realisable value

- Investment in listed securities valued under SEBI (ICDR) Regulations

- Valuation of Land and building Fair market value based on expert’s report

- Investment in holding company sump of parts method

Even though Valuation is done at fair value it seems Shreno has been valued at discount for holding investment as exit given to public shareholders.

Conclusion

The demerger will create three entities for the group one with Active pharmaceutical ingredient business including investment in APL and Paushak as Alembic listed entity and another with real estate, project management and glass into Shreno into unlisted entity and final Nirayu which will be holding company for Alembic including investment in APL and Paushak. Exit to the public shareholders from Real Estate and Project management considering this business smaller in size and also cancellation of intercompany holding as this was not captured in market cap. of Alembic holding company. However, going forward management may further simply structure with consultation of alembic into APL and create for all the shareholders.

That's a great article and detail regarding the stocks. What are the habits of good investor? and how to pick a right investment option?

ReplyDeleteall types of stocks

Marico

best franklin templeton mutual fund

ujjivan financial services

analyst estimates

what is the stock market

mutual fund news

hindalco share price

Great Information! Its looking Nice.....

ReplyDeletehelios capital samir arora

Nice Blog and Good information. I will try to add

ReplyDeleteHow much do I expect to earn on stock investment?

rpg life sciences

ashok leyland share price target

what is nifty

sell on infibeam

adani port share price

short term stock recommendations

berger share price

sundaram mutual fund

Good Information, keep up the good work...

ReplyDeleteIDFC Bank shares

Nippon India MF

Great Work! Thanks for sharing valuable information. You may also check

ReplyDeleteHindustan Unilever Limited

Reliance Industries

Morgan Stanley

Torrent Power Stock

Good Article. Thanks for your efforts. Keep it up. Where else you can also chech these topics like

ReplyDeleteEquity Capital Markets

Ujjivan Small Finance Bank IPO

Ola company

UTI AMC IPO

Good Article. Thanks for sharing such greatful information.

ReplyDeleteMukesh Trends Lifestyle IPO

UTI AMC

IREDA

Bharat-22 ETF

Good information. Thanks for sharing. If you want to know more about stock market related topics then visit

ReplyDeleteMobiKwik Lite Smart APP

State Bank of India

Global private equity fund

Bajaj Energy Ltd

Good information. Thanks for sharing. If you want to know more about stock market related topics then visit

ReplyDeleteSBI Credit Card Business IPO

Tata Capital

Ujjivan Small Finance Bank

Spandana Sphoorty Financial Ltd

Nice Article.This post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

ReplyDeleteforex broker

hedge funds