Merged Lux – from For Men to for family

The Board of Directors of Lux Industries Limited have approved the scheme of merger of its group entities J. M. Hosiery & Co. Limited and Ebell Fashions Private Limited with Lux Industries Limited.

Lux Industries Limited (Lux), incorporated in 1995 is one of the largest players in the hosiery business in India. Products include Men’s, Women’s & Kids Innerwear, Winterwear, Socks & Slacks for Women in varied colours and designs. LUX has a presence across the globe with exports to 47 countries.

J.M Hosiery & Co. Limited (JM) is engaged in the business of manufacturing, marketing, selling and distribution of knitted apparel including hosiery. The Manufacturing unit of the company is in Tiruppur in the state of Tamil Nadu.

Ebell Fashions Private Limited (Ebell) is engaged in the business of manufacturing, marketing, selling and distribution of knitted apparel for women’s. The Manufacturing unit of the company is in Dankuni, Kolkata.

Transaction

The prime rationale behind the merger could bring the growing brands under the listed entity. JM operates into premium segment under the brand “Gen X” and Ebell is into rapidly growing women knitted apparels. In future, this merger can pave the way for Lux to have premium products in all segments in its product portfolio. The appointment date for the transaction is 1st April 2018.

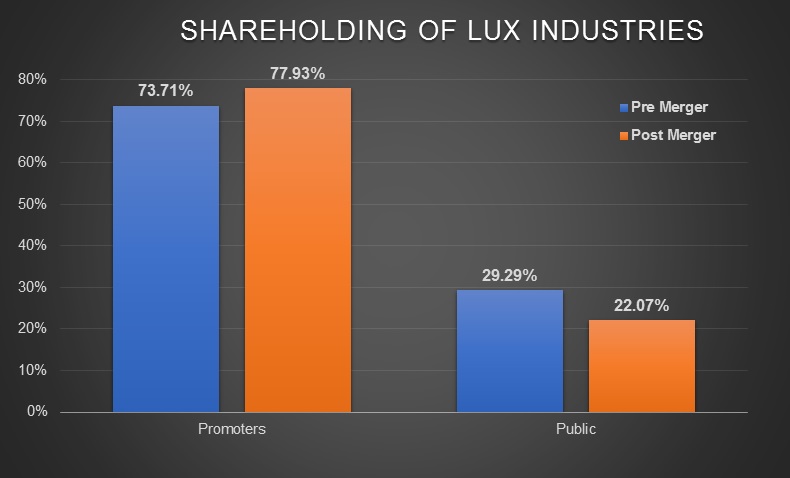

Shareholding Pattern of Lux Industries

JM & Ebell belongs to the promoter group and the entire share capital of both are held by promoters except for the 1.32% of JM is held by Lux.

Post-transaction, Promoters stake in the company will be increased beyond the maximum limit. In near future, promoters will have to bring their holding in the company to ~75% in compliance with SEBI listing norms.

Swap Ratio

- For every 100 equity shares held in JM will be entitled to receive 29 equity shares of Lux.

- For every 100 equity shares held in Ebell will be entitled to receive 1142 equity shares of Lux.

Financials

Table 1: FY 18 & FY 17 Financials of Lux Industries

| Particulars | LUX | |

| 2018 | 2017 | |

| Revenue | 1137 | 971 |

| EBIT % | 13.1% | 11.7% |

| PAT % | 7.0% | 6.5% |

| CFO | -2.32 | 20.52 |

| Total Debt | 321 | 240 |

| Networth | 320 | 241 |

| Capital Employed | 641 | 481 |

| RoCE | 23.2% | 23.7% |

| Working Capital % Sales | 44.0% | 39.9% |

Table 2: FY 17 & FY 18 Financials of Subsidiaries

| Particulars | JM | Ebell | ||

| 2018 | 2017 | 2018 | 2017 | |

| Revenue | 292 | 251.0 | 198.1 | 164.8 |

| EBIT % | - | 6.0% | - | 16.2% |

| PAT % | 5.5% | 3.5% | 10.6% | 10.0% |

| CFO | - | 9.4 | - | 4.8 |

| Total Debt | 111 | 102 | 15 | 18 |

| Networth | 91.49 | 75.0 | 52.0 | 30.7 |

| Capital Employed | 202.5 | 176.77 | 67.0 | 48.4 |

| RoCE | NA | 8.5% | NA | 55.1% |

| Working Capital % Sales | 0.0% | 59.9% | 0.0% | 23.1% |

Table 3: Lux Industries related party transaction in FY 17 (All Figs in INR Crores)

| Particulars | Lux |

| JM | |

| Sale of Goods | 7.89 |

| Purchases | 20.72 |

| Ebell | |

| Sale of Goods | 1.05 |

| Purchases | 6.52 |

| Others | 3.85 |

The group companies are continuously engaged in various transactions with each other. The scheme will help in reduction in various regulatory compliances related to transactions with related parties in future.

Assigned valuation

Table 4: Valuation of All Companies

| Particular | Amount in crore |

| Value assigned to JM | 406 |

| Value assigned to Ebell | 510 |

| Value assigned to Lux | 4,492 |

| No. of equity share (Pre) | 2,52,53,000 |

| No. of equity shares (Post) | 3,00,71,682 |

| Dilution | 19% |

| Increase in Revenue | 43.10% |

| Increase in EBIT | 38.26% |

Valuation Multiple’s

| Particular | Lux | JM | Ebell |

| Revenue | 4.0 | 1.4 | 2.6 |

| PAT | 56.2 | 25.4 | 30.8 |

Conclusion

The proposed merger is a step towards increasing the product portfolio of the listed umbrella company. The merged entity will definitely optimise distribution and marketing cost. In the process, the company will reap befits of cost optimisation for raw materials with better terms in pricing and credit terms. The scheme will pave the way for Lux to add premium product in its basket and will simultaneously achieve a better corporate governance for the company. All the above, it will hopefully unable the company to attract smart and long-term capital.

Comments

Post a Comment