INDIAN METAL - SIMPLIFY STRUCTURE

INDIAN METAL & FERRO ALLOYS LIMITED (IMFA), a pioneer in producing silicon alloys, today focus is on ferrochrome which imparts the non-corrosive property to stainless steel. A significant portion above 80% of output is exported to the Far East (China, Japan & Taiwan). However, domestic consumption to go up sharply as it is ideally positioned to cater demand. The company 40% revenue is from long term contract with POSCO, Nisshin Steel, JSW, etc. The company has mining division to cater to the raw material requirement. The entire output is consumed in-house. The company also has power division which is a captive power plant. The company is fully integrated with both the captive chrome ore and captive power generation capacity.

The company has six furnaces adding up to 187 MVA have been set up at Therubali (Rayagada District) and Choudwar (Cuttack District) in Odisha thus making us the largest merchant producer of ferrochrome in India capable of producing up to 275,000 tonnes per annum.

The company has built zero effluent water discharge system, automated plants for manufacture 100,000 bricks per day from fly ash & slag. The company has commissioned Low Density Aggregate (LDA) or sintered fly ash aggregate plant at Choudwar, Dist-Cuttack, Odisha with an installed capacity of 1,75,000 MT per annum. LDA is unique among fly ash based products with more than 90% fly ash in its composition.

The company has various subsidiaries, but currently major business is in the company. The Subsidiaries are as follows:

Table No 1: Subsidiaries Companies| Sr. no. | Name of the Company | %age | Equity Investment as on 31st March 2017 (Rs. in cr.) | Loan Given (Rs. in cr.) |

| 1. | IMFA Alloys Finlease Limited | 76% | 2.30 | - |

| 2. | Indian Metals and Carbides limited | 99.99% | 0.06 | - |

| 3. | Utkal Coal Limited | 79.2% | 111.42 | 262.81 |

| 4. | Utkal Green Energy Limited | 100% | 1.06 | - |

| 5. | Utkal Power Limited | 100% | 0.45 | - |

| 6. | Indmet Mining Pte Limited (Singapore) | 100% | 53.13 | - |

| 7. | Pt Sumber Rahayu Indah (Indonesia) | 70% | Step down subsidiary – (Subsidiary of Indmet) | - |

- PT Sumber is holding a coal mining concession in Indonesia but due to overlapping boundary issues, the mining concession could not be operationalised till date. No provision is considered necessary by the Company at this stage towards any diminution in the carrying value of it’s investment in Indmet amounting to Rs. 53.13 crore.

- The Hon’ble Supreme Court of India vide judgment dated 25th August 2014 read with its order dated 24th September, 2014 cancelled the allocation of coal blocks ‘Utkal C’ coal block held by Utkal Coal Ltd.(‘UCL’). UCL has filed a Writ and Special Leave Petition against writ petition order by High Court before the Hon’ble Supreme Court challenging the order. Pending resolution of the said matters, no accounting adjustments have been made by UCL in its books of account. The Company’s has exposure in UCL as at 31st March 2017 amounting to Rs. 111.42 crore invested as equity and Rs. 262.81 crore given as an unsecured loan. As an outcome of writ petition the company can get only refund of money given for the coal blocks as those coal blocks are already auctioned to the companies who are actual users.

- Utkal Green Energy Limited and Utkal Power limited are engaged in some of the power projects of the company.

- The investment in Indian Metals and Carbides limited has been impaired by the company in last year from Rs. 1.12 crores to Rs. Rs. 0.06 crores

TRANSACTION

The Board of Directors of the Company approved a Scheme of Amalgamation involving amalgamation of Indian Metals and Carbide Limited (IMCL), a wholly owned subsidiary of the Company and B. Panda and Company Private Limited (B Panda), the holding company of the Company, into the Company.

Please note: The scheme is subject to necessary regulatory approvals, will be effective from the appointed date i.e. 1st April 2017 and no effect to the same has been given in the books of accounts as yet.

Earlier to this transaction, companies which held major investment in IMFA where consolidated with B Panda and unrelated undertakings mainly real estate and other investment were demerged into the resulting companies. This transaction was executed through the Composite Scheme of Arrangement between B.Panda and Company Private Limited (Transferee Company) and Barabati Investment & Trading Co. Private Limited, Indmet Commodities Private Limited, K. B. Investments Private Limited, Madhuban Investments Private Limited, Paramita Investments & Trading Company Private Limited (collectively referred to as the “Transferor Companies” and individually referred to as a “Transferor Company”), Utkal Real Estate Private Limited, Barabati Realtors Private Limited, BP Developers Private Limited (collectively referred to as the Resulting Companies” and individually referred to as a “Resulting Company”) and their respective shareholders, Transferor Companies got merged with the Transferee Company effective 22nd November, 2016. Having Appointed Date 1st April 2013.

AMALGAMATIONS

All the Transferor Companies were directly or indirectly subsidiaries of B Panda holding stake as mentioned below and the remaining stake was owned by Panda Group directly. The consolidation with B Panda was in Ratio as mentioned below:

Table No 2: Earlier Amalgamating Companies| Company Name | Stake owned by B Panda | Merger Swap ratio for allotment to Family Member |

| Barabati Investment & Trading Co. Private Limited (BITCPL) | 98.76% through MIPL | 1:6 |

| Indmet Commodities Private Limited (ICPL) | 73% | 1:470 |

| K. B. Investments Private Limited (KBIPL) | 98.44% | 43:132 |

| Madhuban Investments Private Limited (MIPL) | 98.43% | 4:13 |

| Paramita Investments & Trading Company Private Limited (PITCPL) | 98.76% through KBIPL | 1:6 |

DEMERGERS

Further the resulting companies were owned by the Panda Group Family not having any business, the Swap Ratio for all demergers was 20:1. The details demerger is as follows

DEMERGER I

Real Estate Undertaking I was transferred to Utkal Real Estate Private Limited (UREPL) with assets base as below:Table No 3: Demerger I Statement of Assets and Liabilities

| **Assets & Liabilities | Amount Book Value (Rs. in crores) |

| Stock in trade* | 0.89 |

| Liabilities | 0.02 |

| Net Assets Total | 0.87 |

** This is subject to change with the Appointed Date

DEMERGER II

Table No 4: Demerger II Statement of Assets and Liabilities| Assets & Liabilities | Amount Book Value (Rs. in crores) |

| Stock in trade* | 0.68 |

| Net Assets Total | 0.68 |

*Stock include land and building Gobinda, Choudwar and office at Raheja Chamber. It is not clear whether any of the property is leased to the IMFA.

** This is subject to change with the Appointed Date

DEMERGER III

Investment Undertaking was transferred to BP Developers Private Limited (BPDPL):Table No 5: Demerger III Statement of Assets and Liabilities

| Assets & Liabilities | Amount Book Value (Rs. in crores) |

| Stock in trade | 0.01 |

| Cash and Bank Balance | 20.32 |

| Investments | 32.55 |

| Loan and Advances | 2.22 |

| Total | 55.10 |

Statement of Assets and liabilities post scheme of Arrangement of B Panda as April 2013:

Table No 6: Remaining B Panda Statement of Assets and Liabilities

| Assets & Liabilities | Amount Book Value (Rs. in crores) |

| Share in IMFA (1,25,18,046 shares) | 1.15 |

| Plant and machinery Car and furniture | 0.04 |

| Advance tax | 2.24 |

| Other Advances | 0.17 |

| Debtors | 0.05 |

| Liabilities | 2.01 |

| Total | 1.64 |

PRESENT SCHEME

RATIONALE

Post internal restructuring between various group private investment company’s management decided to further simplify the holding structure in listed entity. The amalgamation of B Panda and IMCL with IMFA will enable consolidation of the undertakings and collapse holding company structure which will simplify and rationalise the holding structure.

NET WORTH POST AMALGAMATION

Based on Audited Financial as on 31.03.2017Table No 7: Net worth of IMFA post amalgamation

| Particulars | Indian Metals |

| Equity Paid Up Capital | 26.98 |

| Reserve and Surplus | 1,092.82 |

| Total /Net Assets | 1,119.80 |

| Net Asset changes due to merger | ** No Major change net worth as below |

Merger of B Panda

**Statement of Assets and liabilities of B Panda as on 1st April 2017Table No 8: B Panda Statement and Liabilities

| Assets & Liabilities | Amount Book Value (Rs. in crores) | |

| Share in IMFA (*1,39,18,046 shares) | 24.25 | |

| Cash Bank Balance | 0.18 | |

| Deferred expenses (Merger) | 0.29 | |

| Other Current Assets | 0.27 | |

| Liabilities | ||

| Trade payable | 0.13 | |

| Payable Inter Group resulting company (BPDPL, BRPL, UREPL | 9.03 | |

| Total | 15.83 | |

- (*) There is an increment in the shares holding of IMFA by B Panda which was through 10 lakhs warrant issued to them @ Rs. 175 per share and 4 lakhs acquisition from the market @ Average Rs. 140 per share in 2016.

- Assets mainly consist of equity investment in IMFA that will be cancelled and will not add to the net worth. The company received dividend of Rs 14 crores+ post the appointed date which is more than the liabilities as on the appointed date. If based on stamp laws in Orissa, if stamp duty is more than the surplus post liabilities than to that extent there will be loss to the public shareholders.

Merger of IMCL

**State of Assets and liabilities of IMCL as on 1st April 2017| Assets & liabilities | Rs. In crores |

| Fixed Assets | 0.04 |

| Unsecured Loan | -0.01 |

| Other Net Assets | 0.16 |

| Total | 0.19 |

Please Note: Investment in Indian Metals & Carbide Limited has been impaired to Rs. 0.06 crores So even though the net assets are higher than investment it will be recorded at impaired value. So, there will be minor addition to net worth of IMFA of Rs. 0.06 crores

CONSIDERATION

Indian Metals & Ferro Alloys is simplifying structure to lower the compliances for promoter’s entities Since in case of merger of IMCL with the company it is amalgamation of Wos with Holding Company there will be not allotment and also IMCL does not carries out any business activities. Whereas B Panda is an Investment company holding 51.59% stake in the company, so it is just holding company structure collapsed. Therefore, the same number of the shares held by B Panda in the company will be allotted the shareholders of B Panda as part of merger against cancellation of their shares. There will be no change in the shareholding of IMFA.

ACCOUNTING & INCOME TAX

It will be done at book value or impaired value as entities being control by same management to comply with the regulations and Accounting standard. The amalgamation will be compliance of Section 2(1B) of the Income Tax Act 1961.

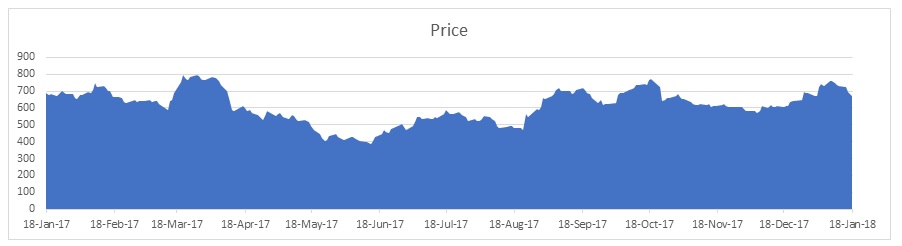

PRICE MOVEMENT

The price movement recently was mainly due to higher realisation and revival in the industry.

CONCLUSION

The simple structure will enable promoters to lower the compliance of the promoter’s entities and focus on the operating business. This will enable to promoters to optimise the taxation by receiving dividend and capital gains on investment in IMFA directly to the individual promoters. The purpose of the scheme seems to be only simplify structure of promotor’s holding and as far as listed company is concerned, there are no commercial or strategic benefits.

Comments

Post a Comment