IDFC paying premium to get acquired, will IDFC be second time lucky?

After the failure of IDFC Bank-Shriram Group merger over valuation, IDFC Bank has now gone for merger with Capital First, a non-banking finance company. The all-share merger deal was done keeping in mind IDFC’s aim to achieve six million customer base by 2020. If the merger goes through, the share of retail loans in the bank’s book would double from the current 26%. And if IDFC becomes second time lucky with this deal, then it can realize its ambition from becoming a dedicated infrastructure financier to a well-diversified universal bank.

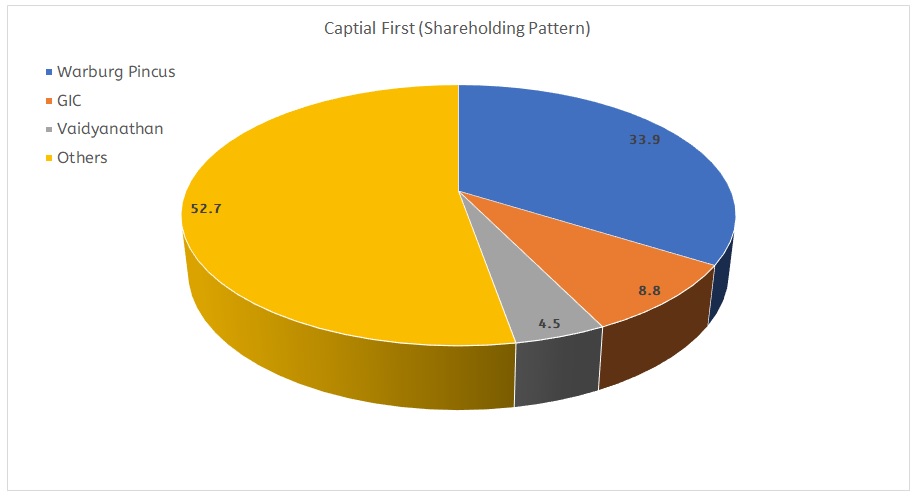

While Capital First and IDFC seem relatively closer in size than Shriram Group, it remains to be seen if the deal can cross all the hurdles including regulatory as well as the problems of personality clashes that often bedevil mergers. Synergies in culture and technology will give the deal an edge. The deal makes some sense for IDFC as it can then expand its retail footprint with adding 228 centres of Capital First’s branches. If the merger goes through, the two entities can create an entity with assets under management of Rs 88,000 crore and customer base of 50 lakh. As per the scheme of amalgamation, IDFC Bank will issue 139 shares for every 10 shares of Capital First. The deal values Capital First, which is owned more than a third by private equity firm Warburg Pincus at Rs 938.25 a share based on the share price of the two companies based on the day of the announcement (January 13).

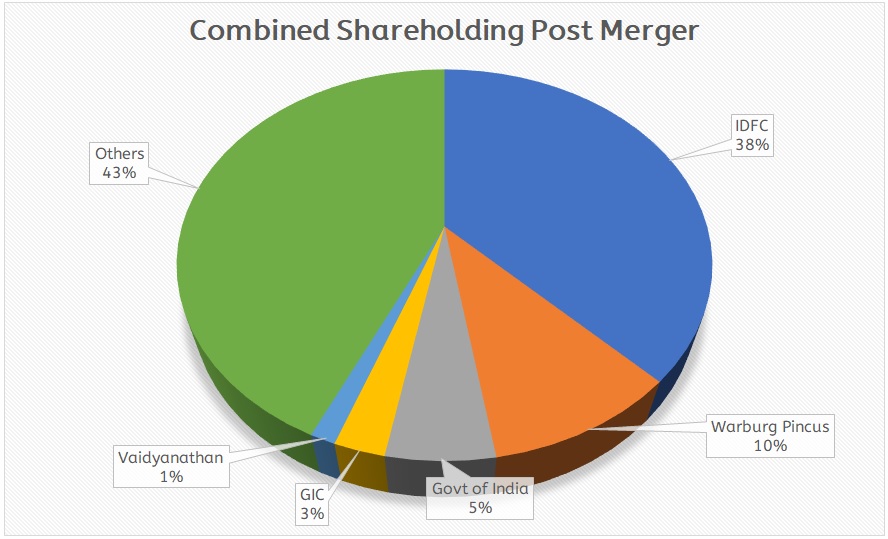

The deal clearly favours Capital First in terms of the swap ratio as the company is richly valued due to return on equity of 12%. Existing shareholders of IDFC Bank and Capita First will retain ownership shares of about 71.2% and 28.8%, respectively. After the merger, V Vaidyanathan, chairman and managing director of Capital First will succeed Rajiv Lall as the MD and CEO of the combined entity. Rajiv Lall will become the non-executive chairman of IDFC Bank.

About Capital First

Capital First Limited is a non-banking finance company specializing in MSME and consumer financing supported by proprietary credit evaluation methodologies and strong credit scoring platform. Warburg Pincus owns 36% in Capital First. The company also offers loans to salaried consumers and small enterprises primarily for home loans, two wheeler loans, durable loans, working capital, short-term business needs and for consumption. The company has a high long-term credit rating of AAA and has a board comprising of reputed professionals with many decades of rich experience in the corporate sector.

In the three months to December 2017, the company reported profit after tax of Rs 87 crore, which is an increase of 42% from Rs 61.4 crore in the same period the previous year. In fact, this is the highest ever quarterly profit in the history of the company. The gross non-performing asset (NPA) of the company reduced sequentially from 1.63% as of September 2017 to 1.59% as of December last year.

About IDFC Bank

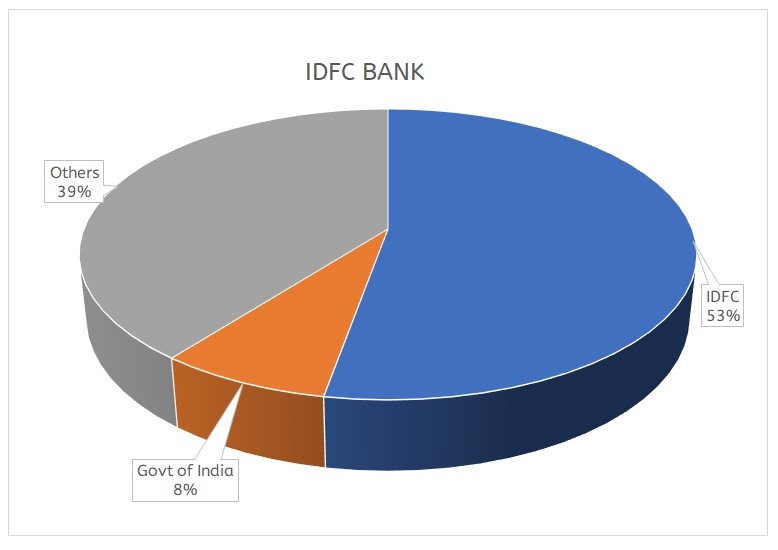

IDFC operates as an infrastructure financing company whose focus areas are energy, telecom and transportation. IDFC owns around 53% stake in IDFC Bank launched in October 2015. IDFC Bank Ltd. (Infrastructure Development Finance Company) is an Indian banking company with headquarters in Mumbai that forms part of IDFC, an integrated infrastructure finance company. The bank started operations on October 1, 2015 and received a universal banking licence from the Reserve Bank of India (RBI) in July 2015. To conform with RBI guidelines IDFC founded a non-operative financial holding company (NOFHC) in 2014 to manage its five subsidiaries IDFC Bank, IDFC MF, IDFC Alternatives, IDFC IDF & IDFC Securities. IDFC is the holding company for NOFHC IDFC Projects Ltd and IDFC Foundation.

Benefits for IDFC Bank and Capital First

For the past two years, IDFC Bank, the youngest universal bank in the country (the other is Bandhan Bank), has been attempting to transform itself into an universal bank with retail focus rather than remain an infrastructure focused bank. The deal will be positive for IDFC Bank as it gives the bank a shot at scaling up its retail business. In fact, IDFC Bank is aggressive in getting Capital First with 40% equity dilution of the former and the deal is valued at 3.1 times the latter’s FY19 estimated book value per share (12% premium to the Capital First’s current value. IDFC Bank, which is more dependent on wholesale lending, has been struggling to grow its retail loan book as well. IDFC’s retail portion of funded credit book is only 27.5%, while 93% of Capital First’s assets under management comprise retail loan like SME loan, loan against property, two-wheeler and consumer durable loan.

| Q2FY18 | IDFC Bank | Capital First | Combined |

| Customers (mn) | 1.9 | 5.1 | 7 |

| Employees | 4677 | 1924 | 6601 |

| Branches | 100 | 228 | 328 |

| Loans (Rs mn) | 488300 | 229735 | 718035 |

| Retail | 40880 | 213284 | 254164 |

| % of retail loans | 8.4 | 92.8 | 35.4 |

| Networth (Rs mn) | 150560 | 24203 | 174763 |

| Total assets (Rs mn) | 1199520 | 199212 | 1398732 |

The conversion of IDFC into a full-fledged bank meant that it had to augment its retail business as commercial lending is laden with non-performing assets. In order to augment retail base, IDFC Bank acquired a small microfinance entity called Grama Vidiyal. Capital First will bring to the table retail lending franchise with a loan book of Rs 22,974 crore, a live customer base of three million customers; and a distribution network in 228 locations across the country growing at a five-year CAFR of 27% of AUM and 40% in profits. On the other hand, IDFC Bank’s deposits add up to just Rs 38,000 crore, and only 8% of this are current and savings accounts. While Capital First gives IDFC Bank access to retail assets, the onus of garnering retail liabilities will depend on the combined entity’s team to cross sell liability products. IDFC Bank’s Rajiv Lall had earlier set a goal to have six million customers by 2020 in order to become one of the top four private banks. With acquiring Capital First, this dream will be fulfilled. While IDFC started its banking journey two years ago, it had faced some challenges along the way. The proposed merger will help the bank to move forward at least five years in terms of retail traction.

For Capital First, the deal is a natural transition as it has created a bank-like retail loan book without garnering any lost-cost capital. It has a robust technology back-end and support system. The deal will amplify these strengths and benefit from getting low-cost funds. The merger will give Capital First access to a bank platform towards early part of the life cycle and also give an opportunity to build a robust banking franchise on IDFC’s existing platform. While Capital First is more profitable, regulatory assets like statutory liquidity requirement, cash reserve ratio and priority sector lending will drag down return on assets.

Shareholding Pattern

Why the deal with Shriram Group failed?

In July last year, IDFC and Shriram Group had agreed to merge to create a financial conglomerate and offer various types of retail and corporate loans. But the deal was called off following differences over valuation or the swap ratio. The concerns were raised by some IDFC shareholders like Enam Holdings and Sipadan Investments (Mauritius) Ltd. Most shareholders of IDFC were demanding a 60% premium to the current market value of the company. The deal could have still worked had Shriram Capital been split into two parts like merging of Shriram City Union Finance and IDFC Bank. However, that was not possible because of the structure of Shriram Capital. Also, the complex structure proposed by dealmakers was the key reason for the merger failing.

The big challenge

The biggest task for the merged entity will be scaling up the current account, savings account (CASA) base to enjoy lower cost of funds as a universal bank. At present, Capital First does not have access to CASA base. Deposits form only 39% of IDFC Bank’s borrowings and the current and savings accounts ratio is just 8.2%. The pass the deal, the company will have to seek regulatory approvals from Reserve Bank of India, Securities and Exchange Board of India (Sebi), Competition Commission of India and the National Company Law Tribunal. The merger process will take three to four quarters because of all the regulatory approvals. IDFC will also end up subscribing further shares as part of the merger to maintained its stake at least at 40% unless RBI relaxes that requirement.

So, in a way the merger is a win-win situation as IDFC Bank will get a strong retail loan book and Capital First will be able to pursue its banking ambitions. While the merger could bump up operations costs in the near term, the merger will benefit the joint entity as the synergistic benefits of lower costs and economies of scale start to accrue over time.

Good Information, keep up the good work...

ReplyDeleteIDFC Bank shares

Nippon India MF